IST,

IST,

Government Securities Market in India – A Primer

The time value of money functions related to calculation of Present Value (PV), Future Value (FV), etc. are important mathematical concepts related to bond market. An outline of the same with illustrations is provided in Box II below.

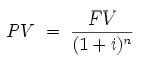

| Time Value of Money Money has time value as a Rupee today is more valuable and useful than a Rupee a year later. The concept of time value of money is based on the premise that an investor prefers to receive a payment of a fixed amount of money today, rather than an equal amount in the future, all else being equal. In particular, if one receives the payment today, one can then earn interest on the money until that specified future date. Further, in an inflationary environment, a Rupee today will have greater purchasing power than after a year. Present value of a future sum The present value formula is the core formula for the time value of money. The present value (PV) formula has four variables, each of which can be solved for: Present Value (PV) is the value at time=0

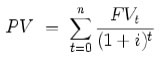

The cumulative present value of future cash flows can be calculated by adding the contributions of FVt, the value of cash flow at time=t

An illustration Taking the cash flows as;

Assuming that the interest rate is at 10% per annum; The discount factor for each year can be calculated as 1/(1+interest rate)^no. of years The present value can then be worked out as Amount x discount factor The PV of ₹100 accruing after 3 years:

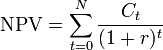

The cumulative present value = 90.91+82.64+75.13 = ₹ 248.69 Net Present Value (NPV) Net present value (NPV) or net present worth (NPW) is defined as the present value of net cash flows. It is a standard method for using the time value of money to appraise long-term projects. Used for capital budgeting, and widely throughout economics, it measures the excess or shortfall of cash flows, in present value (PV) terms, once financing charges are met. Formula Each cash inflow/outflow is discounted back to its present value (PV). Then they are summed. Therefore

Where In the illustration given above under the Present value, if the three cash flows accrues on a deposit of ₹ 240, the NPV of the investment is equal to 248.69-240 = ₹ 8.69 |

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: Please follow the below given step to revise the FLA return for a previous year:

Visit https://flair.rbi.org.in/fla/faces/pages/login.xhtml → Login to FLAIR → Click on MENU tab on the left-hand side of the homepage → ONLINE FLA FORM → FLA ONLINE FORM → “Please click here to get the approval to fill revised FLA form for current year after due date /previous year” → select "Year" and click on  → Click “Request”.

→ Click “Request”.

Your request status will be visible in the table below available on the screen. After sending request to RBI through FLA portal, entities need to wait for at least one working day for approval. Entities can check the status of their request in “Multiple Year Enable Screen” under menu on the left corner. Once approved by DSIM, RBI, the entity can revise FLA return for selected year.

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: Debt securities with original maturity of one year or less is classified as short-term debt securities. Examples of short-term securities are treasury bills, negotiable certificates of deposit, bankers’ acceptances, promissory notes, and commercial paper.

Foreign Investment in India

Answer: No, renunciation of rights shares shall be done in accordance with the instructions contained in Para 6.11 of Master Direction - Foreign Investment in India dated January 4, 2018, read with Regulation 6 of FEMA 20(R).

Indian Currency

C. Different Types of Bank Notes and Security Features of banknotes

₹500, ₹1000 and ₹10000 banknotes, which were then in circulation were demonetized in January 1946. The higher denomination banknotes in ₹1000, ₹5000 and ₹10000 were reintroduced in the year 1954, and these banknotes (₹1000, ₹5000 and ₹10000) were again demonetized in January 1978.

Recently, banknotes in the denomination of ₹500 and ₹1000 issued under the Mahatma Gandhi Series have been withdrawn from circulation with effect from the midnight of November 08, 2016 and are, therefore, no more legal tender.

As regards prohibition on holding, transferring or receiving specified bank notes, Section 5 of The Specified Banknotes (Cessation of Liabilities) Act, 2017 reads as under:

On and from the appointed day, no person shall, knowingly or voluntarily, hold, transfer or receive any specified bank note:

Provided that nothing contained in this section shall prohibit the holding of specified bank notes—

(a) by any person—

(i) up to the expiry of the grace period; or

(ii) after the expiry of the grace period,—

-

not more than ten notes in total, irrespective of the denomination; or

-

not more than twenty-five notes for the purposes of study, research or numismatics;

(b) by the Reserve Bank or its agencies, or any other person authorised by the Reserve Bank;

(c) by any person on the direction of a court in relation to any case pending in the court

Directions and Circulars issued by RBI from time to time in connection with SBNs are available on our website www.rbi.org.in under Function wise sites>>Issuer of Currency>>All You Wanted Know About SBNs. /en/web/rbi/-/all-you-wanted-to-know-from-rbi-about-withdrawal-of-legal-tender-status-of-%E2%82%B9-500-and-%E2%82%B9-1000-notes-3270

Core Investment Companies

Core Investment Companies (CICs)

Ans: Yes, CICs may be required to issue guarantees or take on other contingent liabilities on behalf of their group entities. Guarantees per se do not fall under the definition of public funds. However, it is possible that CICs which do not accept public funds take recourse to public funds if and when the guarantee devolves. Hence, before doing so, CICs must ensure that they can meet the obligation there under, as and when they arise. In particular, CICs which are exempt from registration requirement must be in a position to do so without recourse to public funds in the event the liability devolves. If unregistered CICs with asset size above Rs. 100 crore access public funds without obtaining a Certificate of Registration (CoR) from RBI, they will be seen as violating Core Investment Companies (Reserve Bank) Directions, 2011 dated January 05, 2011.

Government Securities Market in India – A Primer

The price of a bond is nothing but the sum of present value of all future cash flows of the bond. The interest rate used for discounting the cash flows is the Yield to Maturity (YTM) (explained in detail in question no. 24) of the bond. Price can be calculated using the excel function ‘Price’ (please refer to Annex 6).

Accrued interest is the interest calculated for the broken period from the last coupon day till a day prior to the settlement date of the trade. Since the seller of the security is holding the security for the period up to the day prior to the settlement date of the trade, he is entitled to receive the coupon for the period held. During settlement of the trade, the buyer of security will pay the accrued interest in addition to the agreed price and pays the ‘consideration amount’.

An illustration is given below;

For a trade of ₹ 5 crore (face value) of security 8.83% 2023 for settlement date Jan 30, 2014 at a price of ₹100.50, the consideration amount payable to the seller of the security is worked out below:

Here the price quoted is called ‘clean price’ as the ‘accrued interest’ component is not added to it.

Accrued interest:

The last coupon date being Nov 25, 2013, the number of days in broken period till Jan 29, 2014 (one day prior to settlement date i.e. on trade day) are 65.

| The accrued interest on ₹100 face value for 65 days | = 8.83 x (65/360) |

| = ₹1.5943 |

When we add the accrued interest component to the ‘clean price’, the resultant price is called the ‘dirty price’. In the instant case, it is 100.50+1.5943 = ₹102.0943

| The total consideration amount | = Face value of trade x dirty price |

| = 5,00,00,000 x (102.0943/100) | |

| = ₹ 5,10,47,150 |

FAQs on Non-Banking Financial Companies

Mutual benefit financial companies (nidhis)

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: Direct investment is a category of international investment in which a resident entity in one economy [Direct Investor (DI)] acquires a lasting interest in an enterprise resident in another economy [Direct Investment Enterprise (DIE)]. It consists of two components, viz., Equity Capital and Other Capital.

ಪೇಜ್ ಕೊನೆಯದಾಗಿ ಅಪ್ಡೇಟ್ ಆದ ದಿನಾಂಕ: