IST,

IST,

Media Interactions

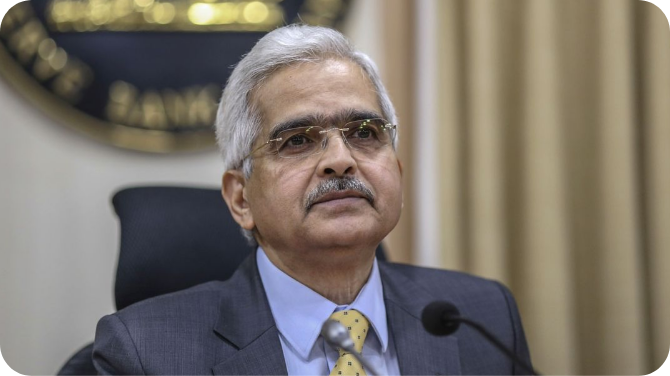

Participants from the RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Dr. O. P. Mall – Executive Director, Reserve Bank of India Dr. Rajiv Ranjan – Executive Director, Reserve Bank of India Moderator: Shri Yogesh Daya

Participants from the RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Dr. O. P. Mall – Executive Director, Reserve Bank of India Dr. Rajiv Ranjan – Executive Director, Reserve Bank of India Moderator: Shri Yogesh Daya

Governor, Shri Shaktikanta Das delivered the 17th K P Hormis Commemorative Lecture on ‘G20 for a Better Global Economic Order during India’s Presidency’ at Kochi on March 17, 2023. After the lecture, the Governor interacted with the audience. The edited excerpts of the interaction are placed below. Moderator: Thank you, sir. The forum is open to questions. If you have any, kindly raise your hand. Gayathri Suresh, FISAT Business School: Good afternoon, sir. My name is

Governor, Shri Shaktikanta Das delivered the 17th K P Hormis Commemorative Lecture on ‘G20 for a Better Global Economic Order during India’s Presidency’ at Kochi on March 17, 2023. After the lecture, the Governor interacted with the audience. The edited excerpts of the interaction are placed below. Moderator: Thank you, sir. The forum is open to questions. If you have any, kindly raise your hand. Gayathri Suresh, FISAT Business School: Good afternoon, sir. My name is

Moderator: Hello, ladies and gentlemen, I don't think I need to introduce the RBI Governor to you. All of you know him, so we can get started straight away. Mr. Das, thank you very much for finding the time today. Has it been the most challenging year of your tenure or would you say the COVID year 2020 was more challenging? Shaktikanta Das: Every challenge in a particular context looks more challenging than the previous one. There were so many situations when I was a

Moderator: Hello, ladies and gentlemen, I don't think I need to introduce the RBI Governor to you. All of you know him, so we can get started straight away. Mr. Das, thank you very much for finding the time today. Has it been the most challenging year of your tenure or would you say the COVID year 2020 was more challenging? Shaktikanta Das: Every challenge in a particular context looks more challenging than the previous one. There were so many situations when I was a

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Dr. O. P. Mall – Executive Director, Reserve Bank of India Shri Saurav Sinha – Executive Director, Reserve Bank of India Shri R. Subramanian – Executive Director, Reserve Bank of India Dr. Rajiv Ranjan – Executive

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Dr. O. P. Mall – Executive Director, Reserve Bank of India Shri Saurav Sinha – Executive Director, Reserve Bank of India Shri R. Subramanian – Executive Director, Reserve Bank of India Dr. Rajiv Ranjan – Executive

Sukumar Ranganathan Good afternoon, everyone. I have with me Mr. Shaktikanta Das, who really needs no introduction, the Governor of the Reserve Bank of India; and I think we can all safely say that his has been one of the reassuring voices, every time when he comes on television to present his policy, especially over the last two years in the course of the pandemic. The Bank has seen us through a really tough phase, and there are challenges ahead, so he and I are goin

Sukumar Ranganathan Good afternoon, everyone. I have with me Mr. Shaktikanta Das, who really needs no introduction, the Governor of the Reserve Bank of India; and I think we can all safely say that his has been one of the reassuring voices, every time when he comes on television to present his policy, especially over the last two years in the course of the pandemic. The Bank has seen us through a really tough phase, and there are challenges ahead, so he and I are goin

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Dr. O. P. Mall – Executive Director, Reserve Bank of India Dr. Rajiv Ranjan – Executive Director, Reserve Bank of India Moderator: Shri Yogesh Dayal –

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Dr. O. P. Mall – Executive Director, Reserve Bank of India Dr. Rajiv Ranjan – Executive Director, Reserve Bank of India Moderator: Shri Yogesh Dayal –

Participants from RBI:Shri Shaktikanta Das – Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri S. C. Murmu – Executive Director, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India (moderator) Shaktikanta Das: Yogesh. We can start. I think everybody has joined the

Participants from RBI:Shri Shaktikanta Das – Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri S. C. Murmu – Executive Director, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India (moderator) Shaktikanta Das: Yogesh. We can start. I think everybody has joined the

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India (moderator) Shaktikanta Das:Good morning everyone. Welcome to this press conference. I

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India (moderator) Shaktikanta Das:Good morning everyone. Welcome to this press conference. I

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India Yogesh Dayal (Moderator): Welcome to the post Monetary Policy Press Conference on Octo

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India Yogesh Dayal (Moderator): Welcome to the post Monetary Policy Press Conference on Octo

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India Shaktikanta Das: I would request the head of our Communication Department, Shri Yogesh

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri T. Rabi Sankar – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India Shaktikanta Das: I would request the head of our Communication Department, Shri Yogesh

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri B.P. Kanungo – Deputy Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India Yogesh Dayal (Moderator): Good afternoon, all of you. I welcome the Governor and Deputy

Participants from RBI: Shri Shaktikanta Das – Governor, Reserve Bank of India Shri B.P. Kanungo – Deputy Governor, Reserve Bank of India Shri M. K. Jain – Deputy Governor, Reserve Bank of India Dr. Michael D. Patra – Deputy Governor, Reserve Bank of India Shri M. Rajeshwar Rao – Deputy Governor, Reserve Bank of India Shri Yogesh Dayal – Chief General Manager, Reserve Bank of India Yogesh Dayal (Moderator): Good afternoon, all of you. I welcome the Governor and Deputy

April 04, 2019 Participants from RBI: Shri Shaktikanta Das – Governor Shri N. S. Vishwanathan – Deputy Governor Dr. Viral V. Acharya – Deputy Governor Shri B. P. Kanungo – Deputy Governor Shri M. K. Jain – Deputy Governor Shaktikanta Das: Good morning. At the outset, I will make the usual statement which I have. Thereafter we will take any questions or observations and will try and accommodate as many questions and observations as possible, so will proceed accordingly

April 04, 2019 Participants from RBI: Shri Shaktikanta Das – Governor Shri N. S. Vishwanathan – Deputy Governor Dr. Viral V. Acharya – Deputy Governor Shri B. P. Kanungo – Deputy Governor Shri M. K. Jain – Deputy Governor Shaktikanta Das: Good morning. At the outset, I will make the usual statement which I have. Thereafter we will take any questions or observations and will try and accommodate as many questions and observations as possible, so will proceed accordingly

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: மே 21, 2025